Atlanta News

TOP ATLANTA STORIES

BREAKING NEWS

Nickeil Alexander-Walker Shines Despite Hawks Loss

Atlanta, Georgia, October 26, 2025 News Summary In a recent NBA game, the Oklahoma City Thunder triumphed over the Atlanta Hawks with a score of 117-100. Nickeil Alexander-Walker delivered a notable...

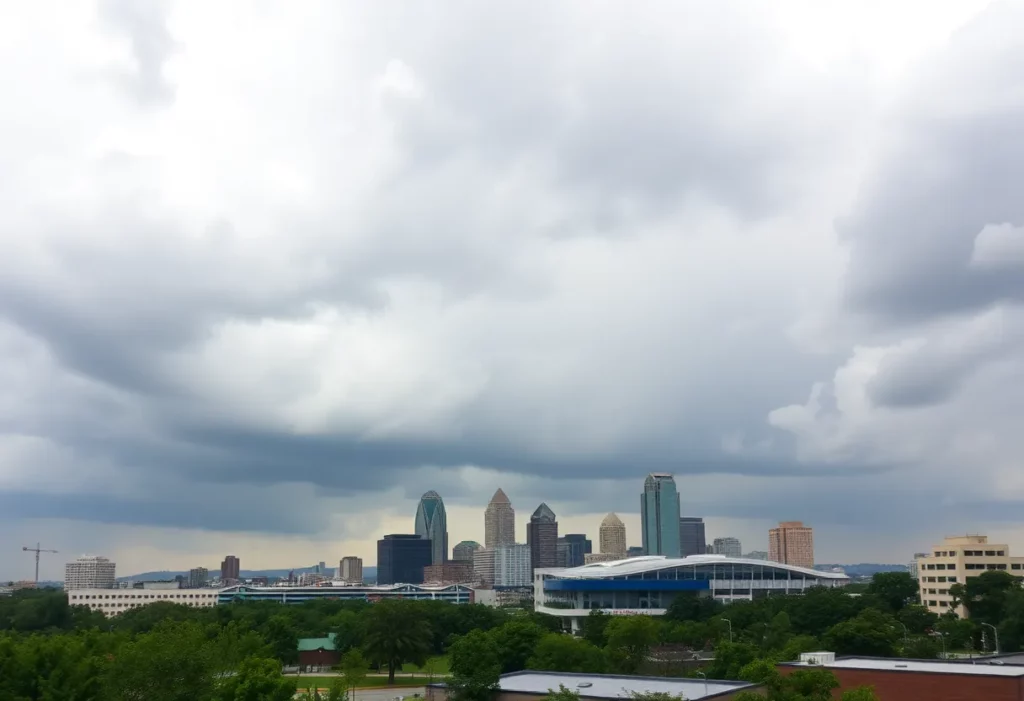

Cold and Rainy Start to the Week in Atlanta, Georgia

Atlanta, Georgia, October 26, 2025 News Summary Atlanta is preparing for a rainy and chilly start to the week, with forecasts predicting widespread rain and strong winds. Temperatures are expected to...

Corruption Allegations Emerge in Atlanta Government

Atlanta GA, October 26, 2025 News Summary Atlanta faces major scrutiny as allegations of corruption among city officials have come to light, suggesting systemic failures impacting consumers and taxpayer dollars. The...

Miami Dolphins End Losing Streak with Victory Over Falcons

Atlanta, Georgia, October 26, 2025 News Summary The Miami Dolphins secured a much-needed 34-10 victory against the Atlanta Falcons at Mercedes-Benz Stadium, marking their first win after a three-game losing streak....

Falcons Set to Face Dolphins with Key Injuries

Atlanta, GA, October 26, 2025 News Summary The Atlanta Falcons will be without starting quarterback Michael Penix Jr. for their upcoming game against the Miami Dolphins due to a knee injury....

Dolphins Overcome Falcons in Disappointing Home Loss

Atlanta, October 26, 2025 News Summary The Miami Dolphins defeated the Atlanta Falcons 34-10, a significant blow for Atlanta’s season. Missing key players, the Falcons struggled offensively and defensively, with Tua...

BUSINESS

Business Profile: Sinclair Construction Group

Sinclair Construction Group has been recognized as one of the premier concrete contracting companies in Georgia’s private and public sectors for a decade. Quality workmanship, commitment to safety, and customer satisfaction...

The 10 Best SEO Companies In Atlanta, GA

Are you a business owner in the Atlanta, GA looking for a reliable SEO company to help increase your online visibility and drive organic traffic to your site? Ranking at...

Events/What's Happening

North Georgia Braces for Rainy and Chilly Work Week

North Georgia, October 26, 2025 News Summary North Georgia is preparing for a rainy and chilly work week, highlighted by several weather advisories. Heavy rain is expected to begin after midnight...

Atlanta Symphony Orchestra Reveals 2025 Holiday Schedule

Atlanta, October 26, 2025 News Summary The Atlanta Symphony Orchestra (ASO) has unveiled its 2025 holiday show lineup featuring award-winning artists, film-inspired concerts, and classic Christmas performances. Highlights include ‘Danny Elfman’s...

Significant Weather Shift Expected in Atlanta

Atlanta, GA, October 25, 2025 News Summary Atlanta is set to experience a considerable weather change this week, with multiple rounds of rain, increased winds, and cooler temperatures moving in. The...

ONE Musicfest Returns to Atlanta’s Piedmont Park

Atlanta, October 25, 2025 News Summary ONE Musicfest is celebrating its 16th year in Atlanta, bringing together music lovers in Piedmont Park. The festival promises a diverse lineup, cultural celebration, and...

Midtown Halloween Block Party Takes Over Atlanta

Atlanta, October 25, 2025 News Summary Atlanta’s Midtown Halloween Block Party is gearing up to be the largest Halloween event in the city. Scheduled for October 25, attendees can expect over...

ONE Musicfest Returns to Atlanta’s Piedmont Park

Atlanta, October 25, 2025 News Summary The 16th annual ONE Musicfest is set to take place in Piedmont Park, Atlanta, this weekend with an expected turnout of over 100,000 attendees. The...

ONE Musicfest Returns to Atlanta This Weekend

Atlanta, October 25, 2025 News Summary Atlanta is hosting the 16th annual ONE Musicfest this weekend at Piedmont Park, expecting over 100,000 attendees. The festival, featuring artists like Future and Ludacris,...

Atlanta Symphony Orchestra Presents Celestial Illuminations

Atlanta, GA, October 25, 2025 News Summary The Atlanta Symphony Orchestra will host ‘Celestial Illuminations’, a concert combining orchestral and Hindustani music traditions. Featuring Gustav Holst’s ‘The Planets’ and special compositions...

Weather Changes on the Horizon for North Georgia

North Georgia, October 24, 2025 News Summary Upcoming weather changes in North Georgia will bring rain, cooler temperatures, and clear skies just in time for Halloween. Tonight, temperatures will drop to...

CRIME

Juvenile Shot During Vehicle Break-In Attempt in Atlanta

Atlanta, GA, October 25, 2025 News Summary A juvenile male was hospitalized after being shot in the foot while attempting to break into a vehicle in Atlanta. The vehicle’s owner confronted...

Atlanta Experiences a String of Violent Incidents

Atlanta, October 23, 2025 News Summary Atlanta is facing growing concerns over public safety due to a series of violent incidents, including shootings and kidnappings. High-profile cases involve a shooting on...

Man Arrested After Mass Shooting Threat at Atlanta Airport

Atlanta, October 20, 2025 News Summary Billy Joe Cagle, a 49-year-old from Cartersville, was arrested at Hartsfield-Jackson Atlanta International Airport after threatening a mass shooting. His family alerted authorities, and he...

Man Arrested for Planning Attack at Atlanta Airport

Atlanta, October 20, 2025 News Summary A man was arrested at Hartsfield-Jackson Atlanta International Airport after his family alerted authorities to his plans to carry out a shooting. Billy Joe Cagle,...

Man Confesses to Murdering Mableton Woman

Cobb County, October 15, 2025 News Summary Cecil McCrary, a 56-year-old man, has confessed to murdering Tange Davis, a 45-year-old Mableton woman who was reported missing last week. After an extensive...

16-Year-Old Boy in Critical Condition After Drive-By Shooting

Atlanta, GA, October 13, 2025 News Summary A 16-year-old boy was shot in a drive-by incident on Flat Shoals Road in East Atlanta while walking with a girl. He is currently...

POLITICS

Corruption Allegations Emerge in Atlanta Government

Atlanta GA, October 26, 2025 News Summary Atlanta faces major scrutiny as allegations of corruption among city officials have come to light, suggesting systemic failures impacting consumers and taxpayer dollars. The...

Atlanta Falcons Suffer Humiliating Loss to Miami Dolphins

Atlanta GA, October 26, 2025 News Summary The Atlanta Falcons faced a disappointing 34-10 defeat at home against the Miami Dolphins, raising serious concerns about their performance and coaching. Despite earlier...

Federal Government Shutdown Threatens SNAP Benefits in Georgia

Atlanta, GA, October 24, 2025 News Summary As the federal government shutdown looms, approximately 1.4 million Georgians may face a cutoff of SNAP benefits starting November 1 if Congress fails to...

Housing Affordability Tops Concerns in Metro Atlanta Survey

Atlanta, Georgia, October 24, 2025 News Summary Recent findings from the Atlanta Speaks Survey reveal that housing affordability is the primary concern for metro Atlanta residents, marking a shift from previous...

Hartsfield-Jackson Atlanta Airport Faces Potential Delays Amid Shutdown

Atlanta, Georgia, October 24, 2025 News Summary Hartsfield-Jackson Atlanta International Airport is alerting travelers about possible delays due to the ongoing government shutdown affecting TSA agents and air traffic controllers. Although...

Atlanta Mayor Unveils $5 Billion City Initiative

Atlanta, GA, October 23, 2025 News Summary Atlanta Mayor Andre Dickens has initiated a transformative $5 billion project aimed at revitalizing housing, transportation, and healthcare in underserved neighborhoods. Key areas of...

Atlanta Falcons Brace for Injury Challenges Ahead of Dolphins Game

Atlanta, GA, October 22, 2025 News Summary The Atlanta Falcons are preparing for a crucial Week 8 matchup against the Miami Dolphins while dealing with multiple injury concerns. Quarterback Michael Penix...

Shooting Near CDC Campus Claims Life of Officer

Atlanta, October 22, 2025 News Summary A shooting incident on Friday near the CDC’s Roybal campus in Atlanta resulted in the death of DeKalb County police officer David Rose. The officer...

Family Alerts Police, Thwart Airport Shooting Attempt in Atlanta

Atlanta, October 21, 2025 News Summary Authorities arrested Billy Joe Cagle after his family alerted them about his threats to shoot at Hartsfield-Jackson Atlanta International Airport. Cagle had brought an AR-15...

SPORTS

Nickeil Alexander-Walker Shines Despite Hawks Loss

Atlanta, Georgia, October 26, 2025 News Summary In a recent NBA game, the Oklahoma City Thunder triumphed over the Atlanta Hawks with a score of 117-100. Nickeil Alexander-Walker delivered a notable...

Miami Dolphins End Losing Streak with Victory Over Falcons

Atlanta, Georgia, October 26, 2025 News Summary The Miami Dolphins secured a much-needed 34-10 victory against the Atlanta Falcons at Mercedes-Benz Stadium, marking their first win after a three-game losing streak....

Falcons Set to Face Dolphins with Key Injuries

Atlanta, GA, October 26, 2025 News Summary The Atlanta Falcons will be without starting quarterback Michael Penix Jr. for their upcoming game against the Miami Dolphins due to a knee injury....

Dolphins Overcome Falcons in Disappointing Home Loss

Atlanta, October 26, 2025 News Summary The Miami Dolphins defeated the Atlanta Falcons 34-10, a significant blow for Atlanta’s season. Missing key players, the Falcons struggled offensively and defensively, with Tua...

Atlanta Falcons Suffer Humiliating Loss to Miami Dolphins

Atlanta GA, October 26, 2025 News Summary The Atlanta Falcons faced a disappointing 34-10 defeat at home against the Miami Dolphins, raising serious concerns about their performance and coaching. Despite earlier...

Atlanta Falcons Suffer Disappointing Loss to Miami Dolphins

Atlanta, GA, October 26, 2025 News Summary The Atlanta Falcons faced a tough defeat against the Miami Dolphins, ending the game 34-10 at Mercedes-Benz Stadium. This result leaves the Falcons with...

Weather Changes Expected in North Georgia This Weekend

Atlanta, October 25, 2025 News Summary A major pattern shift is forecasted for North Georgia beginning Sunday, featuring widespread rain, gusty winds, and a significant drop in temperatures. Residents in the...

Syracuse Football Faces Heavy Loss Against Georgia Tech

Atlanta, October 25, 2025 News Summary The Syracuse football team was defeated by No. 7 Georgia Tech with a score of 41-16, marking a tough game for the Orange. Despite a...

Falcons Adjust Roster Ahead of Matchup Against Dolphins

Atlanta, October 25, 2025 News Summary The Atlanta Falcons are making significant roster adjustments due to injuries ahead of their upcoming game against the Miami Dolphins. Linebacker Diablo is sidelined with...